Summitpath Llp Things To Know Before You Get This

Table of ContentsSummitpath Llp - Questions10 Easy Facts About Summitpath Llp ShownIndicators on Summitpath Llp You Should KnowThe Main Principles Of Summitpath Llp

Most recently, launched the CAS 2.0 Technique Growth Training Program. https://experiment.com/users/summitp4th. The multi-step coaching program includes: Pre-coaching alignment Interactive group sessions Roundtable conversations Embellished mentoring Action-oriented mini prepares Firms aiming to broaden right into advising solutions can also turn to Thomson Reuters Method Ahead. This market-proven method offers content, devices, and advice for firms interested in advising solutionsWhile the changes have opened a variety of growth opportunities, they have also led to difficulties and concerns that today's firms need to carry their radars. While there's difference from firm-to-firm, there is a string of usual difficulties and problems that tend to run industry broad. These include, yet are not limited to: To stay affordable in today's ever-changing regulatory atmosphere, firms need to have the capacity to promptly and efficiently perform tax study and improve tax reporting effectiveness.

Furthermore, the new disclosures may result in an increase in non-GAAP actions, historically an issue that is highly inspected by the SEC." Accounting professionals have a great deal on their plate from governing changes, to reimagined service designs, to an increase in customer assumptions. Keeping speed with all of it can be challenging, but it doesn't need to be.

Facts About Summitpath Llp Revealed

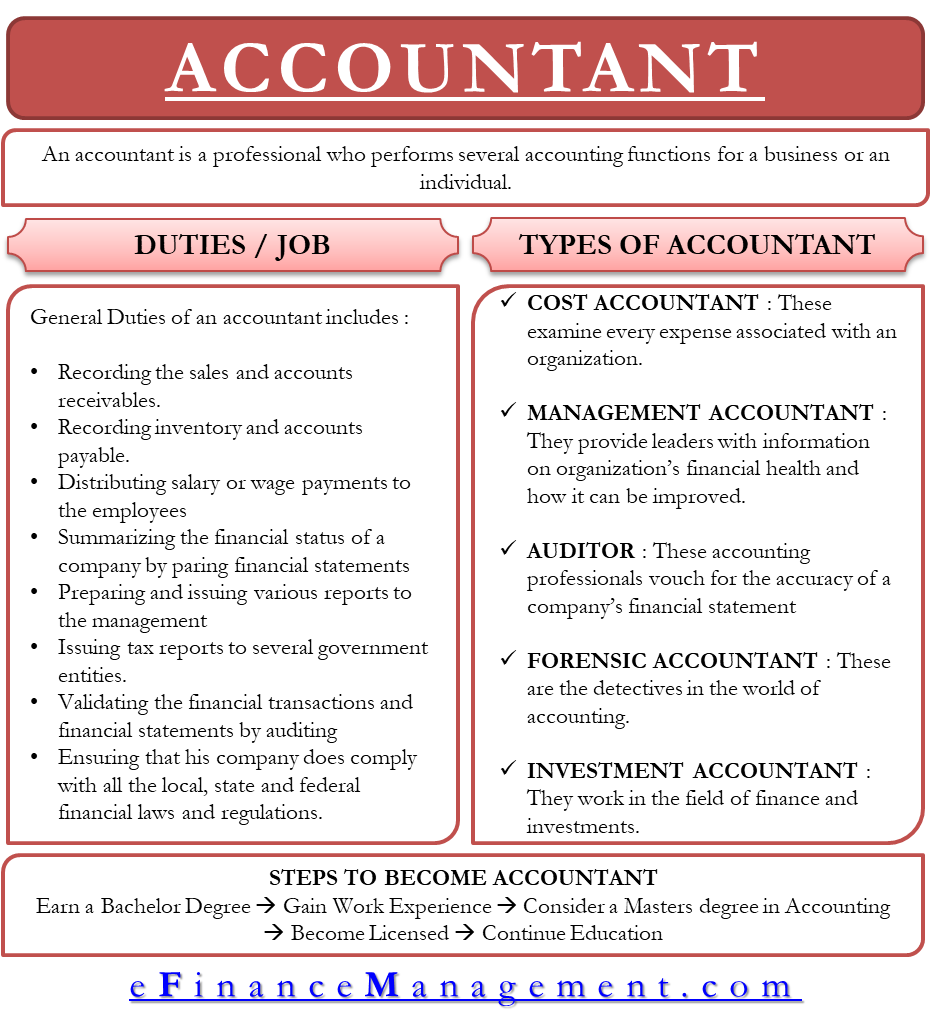

Listed below, we explain 4 certified public accountant specialties: taxes, administration audit, economic coverage, and forensic accounting. CPAs specializing in tax help their customers prepare and file income tax return, reduce their tax obligation worry, and stay clear of making blunders that might result in expensive penalties. All CPAs require some expertise of tax legislation, but specializing in taxes suggests this will be the focus of your job.

Forensic accounting professionals typically start as basic accountants and move right into forensic audit roles with time. They require solid analytical, investigative, business, and technical accountancy skills. CPAs that focus on forensic accounting can in some cases go up right into administration audit. CPAs need at the very least a bachelor's level in accountancy or a similar area, and they should finish 150 credit history hours, consisting of bookkeeping and business courses.

No states call for an academic degree in accountancy. An accounting master's degree can aid trainees fulfill the CPA education demand of 150 credit reports since most bachelor's programs only require 120 debts. Accounting coursework covers subjects like finance - https://writeablog.net/summitp4th/navigating-the-financial-rockies-your-guide-to-a-stellar-calgary-accountant, auditing, and tax. As of October 2024, Payscale records that the ordinary annual salary for a certified public accountant is $79,080. tax planning.

And I suched as that there are great deals of various job alternatives which I would certainly not be jobless after college graduation. Bookkeeping additionally makes useful sense to me; it's not simply academic. I like that the debits always need to amount to the debts, and the annual report needs to stabilize. The CPA is an important credential to me, and I still get proceeding education credit reports annually to stay up to date with our state demands.

Not known Facts About Summitpath Llp

As an independent expert, I still use all the fundamental building blocks of bookkeeping that I learned in college, seeking my certified public accountant, and operating in public bookkeeping. Among things I truly like concerning accountancy is that there are numerous different work readily available. I decided that I wished to begin my career in public accounting in order to discover a great deal in a brief amount of time and be revealed to various types of clients and various locations of audit.

"There are some offices that do not wish to take into consideration someone for an audit function who is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CPA A certified public accountant is a very important credential, and I intended to place myself well in the marketplace for numerous work - Calgary CPA firm. I decided in university as a bookkeeping major that I desired to attempt to get my certified public accountant as quickly as I could

I have actually fulfilled lots of wonderful accounting professionals that do not have a CPA, however in my experience, having the credential actually aids to promote your competence and makes a difference in your compensation and job alternatives. There are some offices that do not intend to take into consideration somebody for an accounting function who is not a CERTIFIED PUBLIC ACCOUNTANT.

The 3-Minute Rule for Summitpath Llp

I truly delighted in servicing numerous kinds of jobs with various clients. link I discovered a whole lot from each of my colleagues and clients. I dealt with several various not-for-profit organizations and discovered that I have an interest for mission-driven organizations. In 2021, I made a decision to take the following action in my bookkeeping occupation trip, and I am currently a self-employed bookkeeping expert and organization consultant.

It proceeds to be a growth location for me. One vital quality in being an effective CPA is truly respecting your customers and their services. I love dealing with not-for-profit clients for that very factor I really feel like I'm truly adding to their objective by aiding them have good economic information on which to make wise organization decisions.